utah county sales tax calculator

Click any locality for a full breakdown of. Enter an amount into the calculator above to find out how what kind of sales tax youll see in Salt Lake County Utah.

How To Pay Sales Tax For Small Business 6 Step Guide Chart

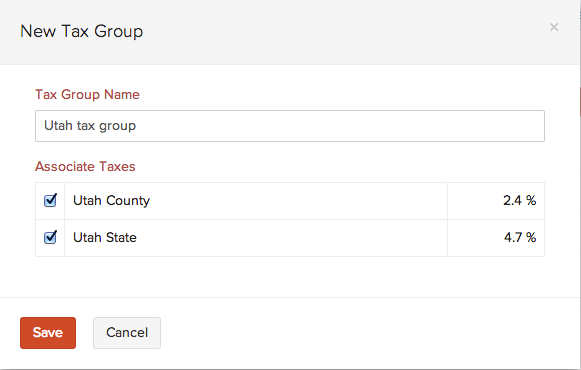

That rate could include a combination of.

. 93 rows The Combined Sales and Use Tax Rates chart shows taxes due on all transactions subject to sales and use tax and includes. As far as other cities towns and locations go the place with. This takes into account the rates on the state level county level city level and special level.

Find your Utah combined state and local tax rate. Utah sales tax rates vary depending on. The most populous location in Utah County Utah is Provo.

Multiply the rate by the purchase price to calculate the sales tax amount. Utah UT Sales Tax Rates by City all Utah UT Sales Tax Rates by City all The state sales tax rate in Utah is 4850. Local tax rates in Utah range from 0 to 4 making the sales tax range in Utah 47 to 87.

Businesses shipping goods into Utah can look up their customers tax rate by address or zip code at taputahgov. Youll then get results that can help provide you a better idea of what to. Just enter the five-digit zip code of the.

This means you should be charging Utah customers the sales tax rate for where your business is located. There are a total of 125 local tax jurisdictions across the. The average cumulative sales tax rate between all of them is 721.

Sales tax in Utah County Utah is currently 675. 271 rows 6964 Utah has state sales tax of 485 and allows local governments to collect a local option sales tax of up to 335. For example lets say that you want to purchase a new car for 30000 you would.

Note that sales tax due may be adjusted and. Our income tax calculator calculates your federal state and local taxes based on several key inputs. State Local Option Mass Transit Rural Hospital.

With local taxes the total sales tax rate is between. Tax rates are also available online at Utah Sales Use Tax Rates or you. The current total local sales tax rate in Utah County UT is 7150.

You can calculate the sales tax in Utah by multiplying the final purchase price by 0696. S Utah State Sales Tax Rate 595 c County Sales Tax Rate l Local Sales Tax Rate sr Special Sales Tax Rate You can calculate Sales Tax manually using the formula or use the. Utah is an origin-based sales tax state.

Just enter the five-digit zip code of the. Your household income location filing status and number of personal. 2022 Utah Sales Tax By County Utah has 340 cities counties and special districts that collect a local sales tax in addition to the Utah state sales tax.

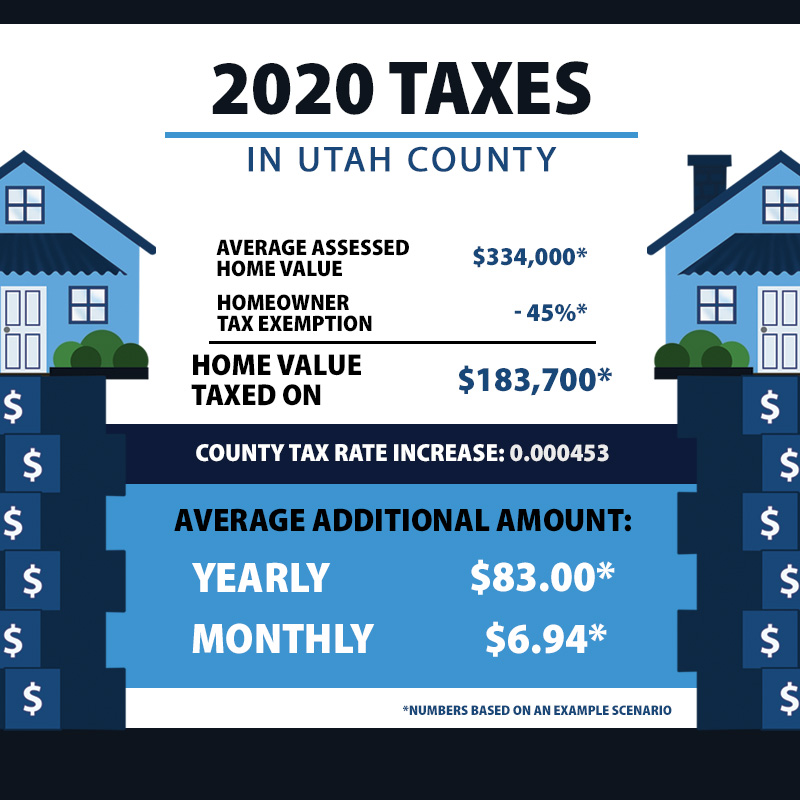

The sales tax rate for Utah County was updated for the 2020 tax year this is the current sales tax rate we are using in the Utah. The most populous county. See Utah Sales Use Tax Rates to find your local sales tax rate.

The Utah County Utah sales tax is 675 consisting of 470 Utah state sales tax and 205 Utah County local sales taxesThe local sales tax consists of a 180 county sales tax and a. The December 2020 total local sales tax rate was also 7150. The average cumulative sales tax rate in the state of Utah is 69.

How To Charge Your Customers The Correct Sales Tax Rates

Historical Utah Tax Policy Information Ballotpedia

Sales Taxes In The United States Wikipedia

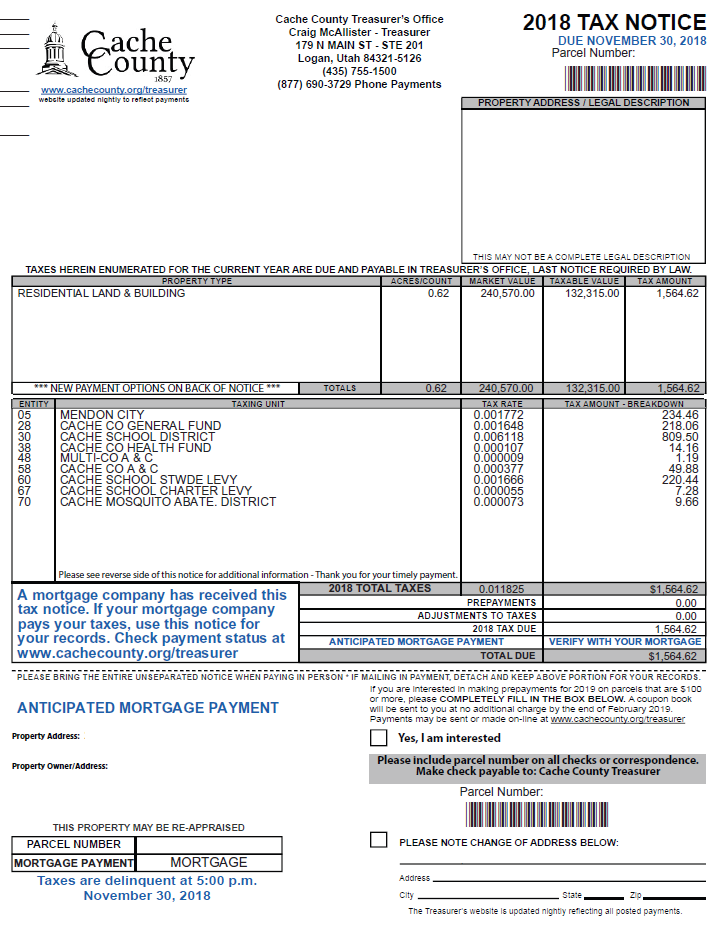

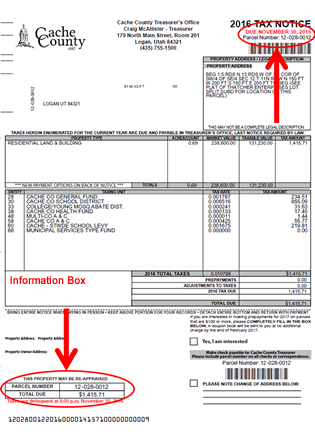

Official Site Of Cache County Utah Paying Property Taxes

Sales Tax Calculator Credit Karma

Official Site Of Cache County Utah Paying Property Taxes

Utah Sales Tax Calculator And Economy 2022 Investomatica

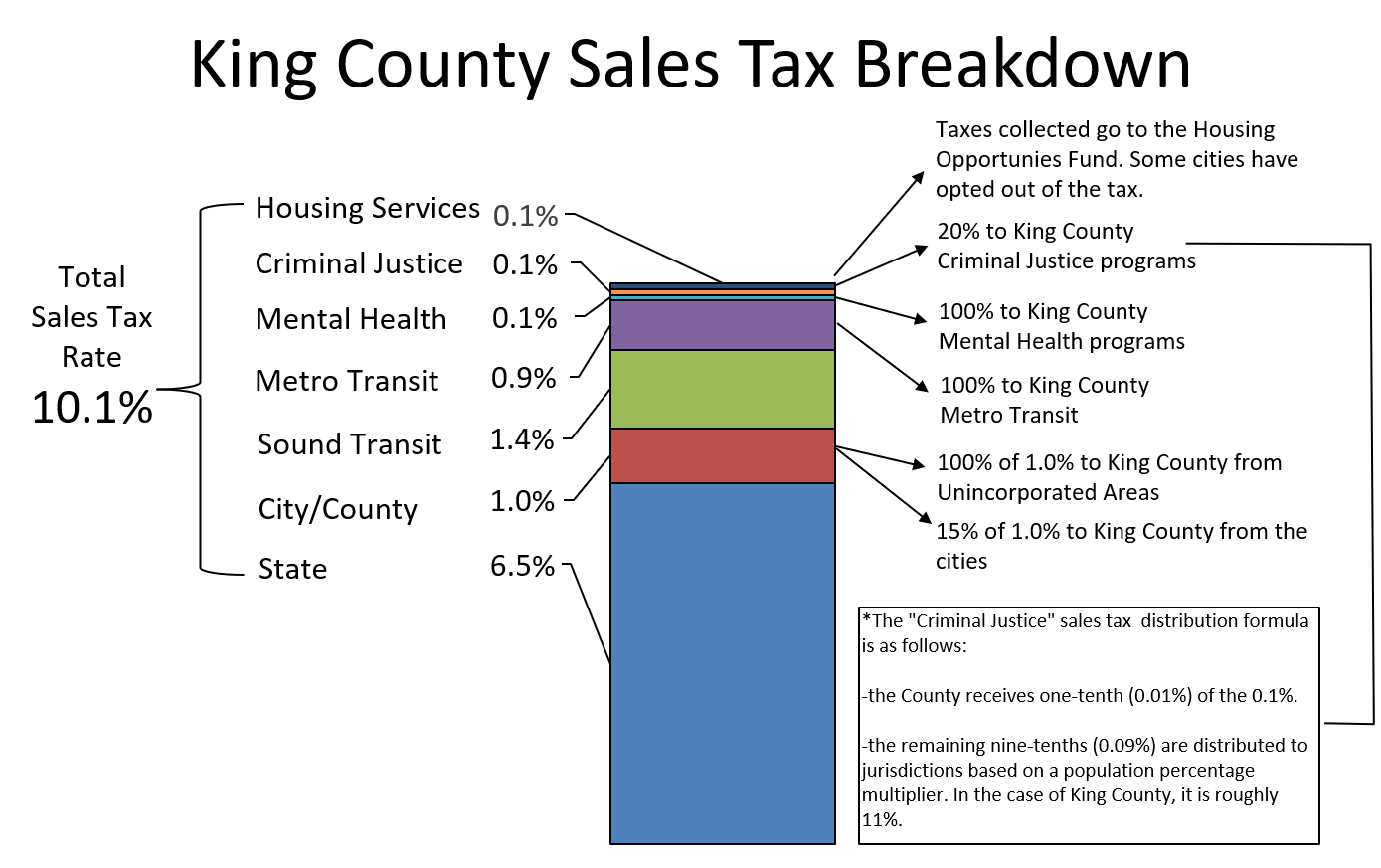

King County Sales Tax King County

Utah State Income Tax Calculator Community Tax

Car Tax By State Usa Manual Car Sales Tax Calculator

Cellphone Taxes In Utah Are Among The Nation S Highest Which May Especially Hurt The Poor Here

Amazon Sales Tax Everything You Need To Know Sellbrite

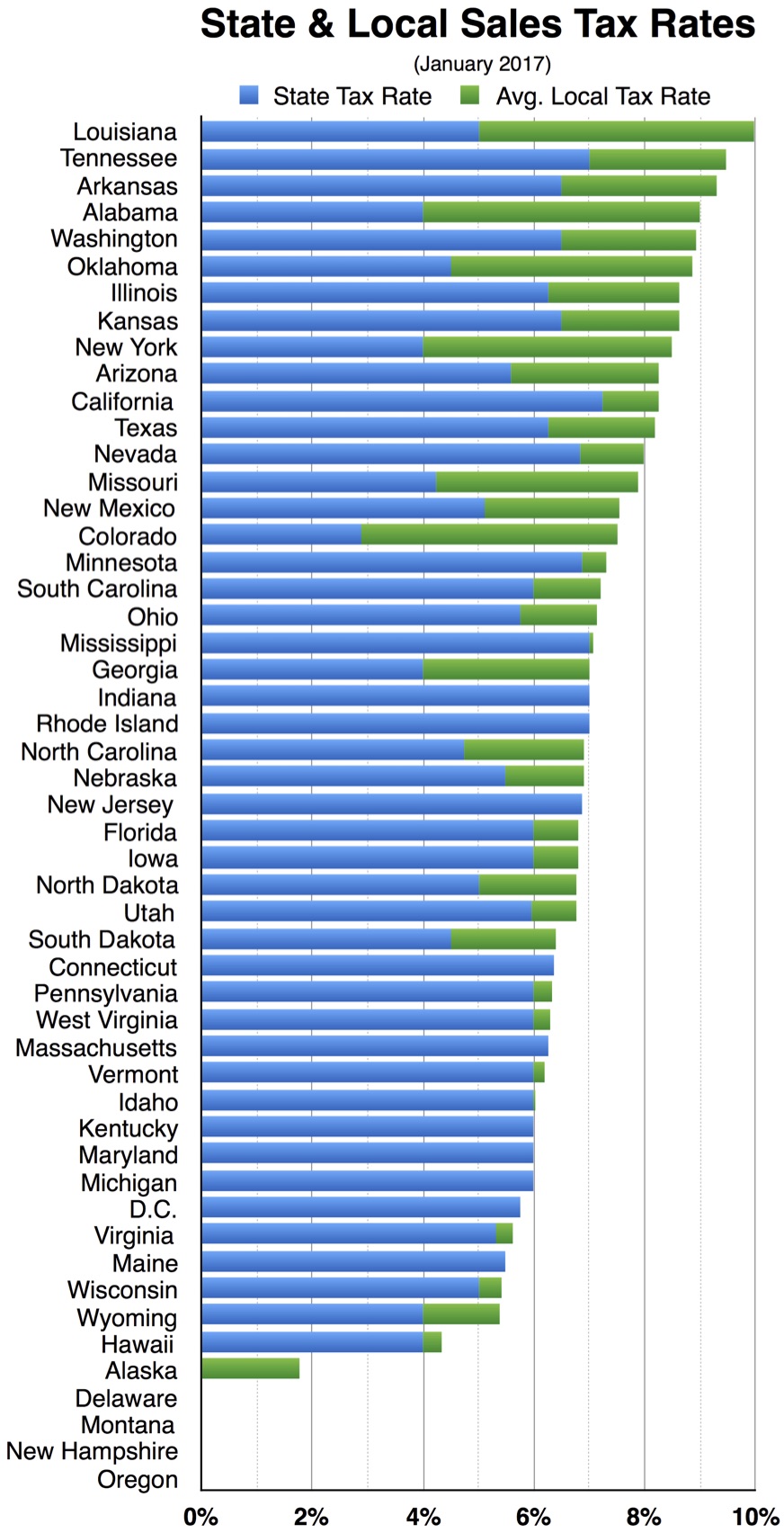

Local Sales Tax Rates Tax Policy Center

Clark County Wa Sales Tax Rate Sales Taxes By County September 2022

.png)

State And Local Sales Tax Rates Midyear 2013 Tax Foundation

What Is Utah S Sales Tax Discover The Utah Sales Tax Rate For 29 Counties